Waldemar przybyła

Product maintainer

Phone +48 61 640 37 72

Mobile +48 601 754 472

E-mail: waldemar.przybyla@eksi.pl

Eksi Finance – export project finance advisor

Eksi Finance – export project finance advisor…

Observing growing turnover of investment goods and services on the international market, especially present on eastern markets, EKSI Finance has developed and successfully provides comprehensive advisory services supporting Polish exporters in the organization and implementation of export contracts and direct investments, including organizing their financing. Projects implemented by EKSI Finance in the field of export finance are of investment nature and mainly regard:

- onstruction / modernization of industrial facilities, e.g. sugar factories, wood processing plants, grain warehouses.

- Construction / modernization of power plants, including conventional (coal), renewable energy – wind, hydro, biomass and photovoltaic.

- Construction / modernization of commercial real estate, e.g. shopping and office centers, retail parks, hotels, logistics centers.

Buyer’s Credit facility.

This is a bank loan directly offered to a foreign Investor (usually SPV – Special Purpose Vehicle) or a foreign, local bank in order to finance an individual export contract. Buyer’s Credit is a very convenient way to finance an export / import transaction. It enables exporters to receive payments for delivered goods and services immediately after presenting documents to the financing bank confirming full or partial performance of the contract. On the other hand, it enables importers (investors) to obtain, at competitive prices, long-term financing of their capital needs; up to 10 – 14 years of repayment depending on the nature of the investment.

KUKE SA insurance policy…

The total loan value (principal plus interest) is insured by Export Credit Insurance Corporation (KUKE SA) – PFR Group, which is backed by the State Treasury of Poland. Thus, having it as collateral banks can apply zero weight risk and reduce the base for creating special purpose reserves for a specific agreement for up to 100% of the amount insured. This in turn supports bank taking on foreign investor’s debt still at very competitive interest quotations. KUKE insurance policies are to support export of Polish goods and services thus involvement of Polish general contractor is mandatory.

Were we advise

KSI Consulting advisors consulted project finance projects exceeding EUR 700 million. Most of them were carried out as part of the “Buyer’s Credit” financing program and covered the areas, among others, of Russian Federation, Belarus, Ukraine, Kazakhstan, Hungary, Thailand, Kazakhstan, Mongolia, Turkey, Georgia, Moldova, Greece and Ghana.

Scope of services

What our advisors offer

Comprehensive consulting services, thanks to which your company will launch on desired foreign market in a business and legal form best suited to the nature of chosen investment, company’s profile as well as its goals and financial limitations.

-

- Business matching. EKSI Finance and our local partners in each country conduct a constant review and collection of data on the markets in which our clients are particularly interested. As a result, we are always ready to indicate available offers and possibilities tailored to presented expectations.

- Financing arrangement. EKSI Finance, upon establishing clients on new market, continues to support them in legal and business terms, assisting at the stage of organizing project financing as well as practical implementation of concluded contracts.

- Daily support and troubleshooting. Understanding the complexity of international transactions EKSI Finance does not limit itself to the above-mentioned services. Advisors work on daily basis with their clients to identify and solve other obstacles companies face during execution of export contracts.

Organization and implementation of export contracts – scope of services

As part of EKSI Finance advisory in the area of export finance, we offer:

-

- Structuring in legal and business aspects.

- Preparation of project financing scheme best suited to the needs of a given investment and client’s goal.

- Advisory on contractual aspects in terms of financing for cross-border projects.

- Preparation of comprehensive project documentation for banks / insurance companies.

- Support for exporters and Investors in negotiations with financing and insurance institutions.

- Supervision over preparation and negotiation of credit and insurance documentation.

Export Finance – korzyści

This type of financing is characterized by:

-

- Cross-border special purpose loan is offered by selected Polish and foreign banks to finance individual export contract for investment project or delivery of goods from Poland..

- The loan is granted directly to local investor or the investor’s bank by a domestic or foreign bank and should be repaid in equal installments, semi-annually at the latest.

- Total loan value (principal plus interest) is covered by Export Credit Insurance Corporation (KUKE), which is backed by the State Treasury of Poland.

- Banks may apply zero weight risk and reduce the base for creating special purpose reserves for a specific loan agreement for up to 100% of the amount insured – this in turn supports banks taking on foreign investor’s debt at very competitive interest quotations.

Benefits for foreign investors.

-

- Access to foreign funds at lower costs as the interest rate are linked to LIBOR. Lower margins and prices due to support of the State Treasury (KUKE insurance cover).

- Possibility to set fixed interest rates. Access to multi-currency financing.

- Possibility of financing an export / import contract with a loan repayment period of 10-14 years.

- KUKE insurance policy as a security allows banks to reduce the base for creating special purpose reserves for a specific loan agreement for up to 100% of the amount insured.

- Insurance coverage applies to most countries around the world, in line with the current policy on officially supported export insurance.

- Policies cover both market and political risks of non-payment.

- WInsurance conditions meet international standards set by OECD and European Union.

Basic structures of export financing

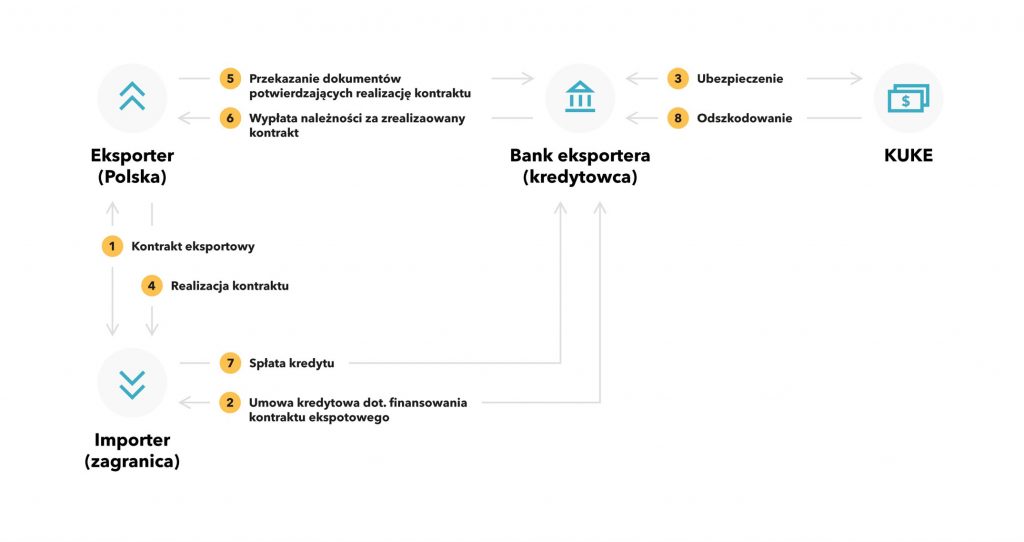

Buyer’s Credit – Bank to Bank

The first variation of the export finance lending product is a loan directly given to a foreign bank (investor’s bank) by a Polish bank and re-lended to a local investor. It is especially suggested for any project of less than 5-8 mln EUR value, as it reduces transaction costs (all securities are negotiated with and granted only to the foreign bank, also all the legal, technical and insurance advisors for Polish lending bank are no longer required) and is substantially less time consuming. Another advantage is that up to 85% of contract value can be financed, thus as low as 15% of advance/equity is needed. Repayment: up to 10 years (for energy projects up to 14 years), in semi-annual (or quarterly) installments commencing no later than 6 months after completion of the investment. Simplified transaction diagram is presented below:

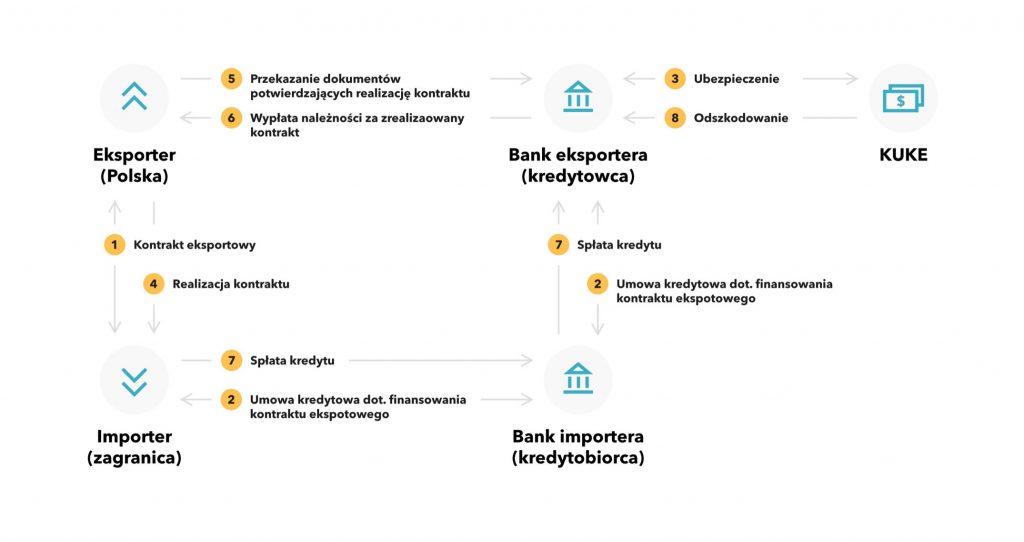

Buyer’s Credit – direct financing

The second variation of the export finance lending product is a loan granted directly to a foreign investor by a Polish bank. This is especially recommended for larger projects (over EUR 5-8 million) – the transaction costs are higher and the process is more time-consuming, but it allows to reduce the financing costs by eliminating the intermediary, local bank. The structure of financing demands at least 30% of equity injection (30/70). Repayment: up to 10 years (for energy projects up to 14 years), semi-annual (or quarterly) installments commencing no later than 6 months after completion of all deliveries / works under the contract. Simplified transaction diagram is presented below::